Mature home battery storage markets in Europe are stabilizing, while emerging markets with strong government incentives are gaining momentum, according to a new report by EUPD Research. The study reveals that home battery prices have plummeted by more than 50% between the first half of 2023 and the first half of this year.

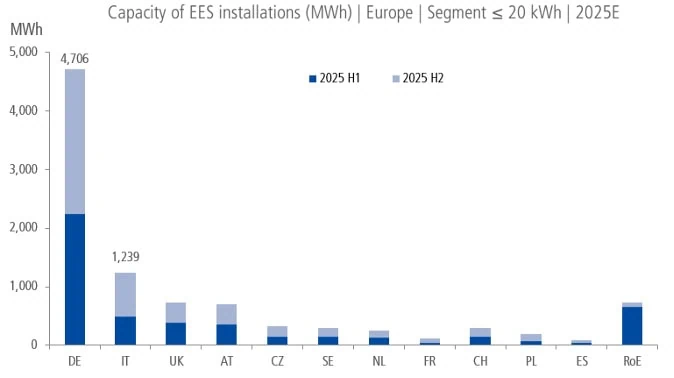

The European home battery market has remained resilient in 2025, supported by significant growth in both mid-sized and fast-developing markets, EUPD Research reports. Its latest Electrical Energy Storage (EES) Report covers residential battery systems with capacities of up to 20 kilowatt-hours.

While mature markets—primarily Germany and Italy—started the year with weaker figures, the overall market trajectory points to continued expansion, with over one million units expected to be installed in households across Europe by the end of the year. The report notes that although the gradual phase-out of subsidies and the dilution of incentive mechanisms led to a slow start in key markets, the outlook for the second half of the year is more optimistic.

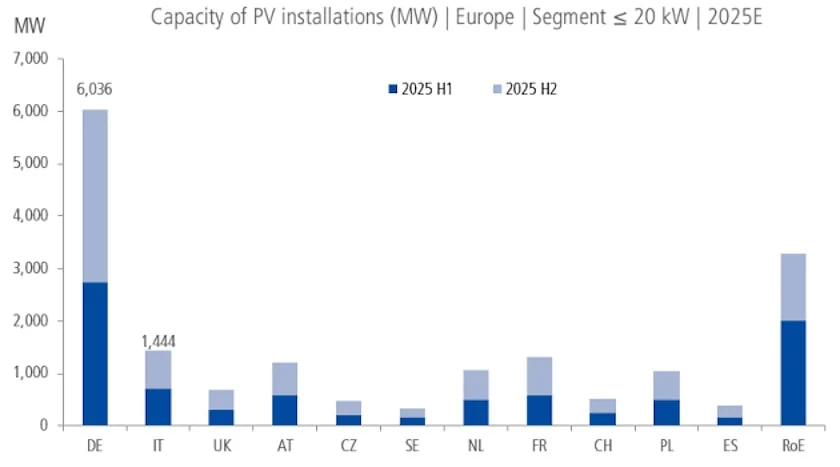

In residential applications, batteries are primarily used to store electricity generated by rooftop, balcony, or carport-mounted photovoltaic (PV) systems.

Photo: New home battery capacity in Europe in 2025 including estimate for the second half of the year (EUPD Research)

Drivers of the Home Battery Market: Self-Consumption and Dynamic Electricity Tariffs

Rising interest in dynamic tariffs and the strengthening of self-consumption are expected to stimulate demand for home battery systems. Dynamic tariffs are electricity pricing schemes defined by contracts where rates fluctuate, typically following wholesale price movements. Furthermore, mature markets are stabilizing, while the strongest momentum is seen in rapidly growing markets with government incentives, according to recent data.

This sector continues to expand, fueled by declining battery prices. The combination of significant lithium cost reductions and increased competition, driven by new market entrants over the past two years, has accelerated price peaks and lowered overall system costs.

The price index, maintained by the mentioned data provider, has more than halved between the first half of 2023 and the first half of this year. The current average price of home batteries, as of the second half of 2025, stands at €711 per kilowatt-hour—46.6% lower than in the first half of 2023.

The segment of newly installed home energy storage systems is experiencing a moderate decline.

Despite a moderate reduction in the total capacity of newly installed home batteries in the first half of 2025, Germany remains the strongest market in Europe, with no signs of weakening demand expected by year-end. The projected annual decline of 6% is mainly attributed to slower photovoltaic deployment, reduced regional incentives, and a pronounced shift toward commercial and industrial (C&I) storage systems and large-scale installations.

Germany Remains Far Ahead of Other Markets

It is estimated that Germany, together with Italy, will account for the lion’s share of new home battery capacity through 2028, despite the current slowdown in Italy caused by the gradual reduction of tax incentives under the Superbonus scheme.

This year, the newly installed home battery capacity in Europe’s largest economy is estimated at 4.7 gigawatt-hours, while new residential solar PV installations reached 6.04 gigawatts. This category includes systems up to 20 kilowatts. Italy is expected to contribute 1.24 gigawatt-hours of battery capacity and 1.44 gigawatts of solar PV.

Photo: New Residential Solar Panel Capacity in Europe 2025, Including Estimates for the Second Half of the Year (EUPD Research)

Steady, Robust Growth Across Several Countries

Markets such as Austria, France, the Netherlands, and the Czech Republic are demonstrating steady and robust growth, driven by rising electricity costs since 2023, increasing adoption of solar systems, consistent government support, and growing awareness of the benefits of energy independence.

Sweden, propelled by tax rebates and a national energy self-sufficiency initiative, is recording a record number of new solar installations combined with home battery systems.

Regarding equipment manufacturers, BYD remained the market leader in 2024 with a 20% market share, and it is expected to reach 21% this year.

Source: Balkan Green Energy News